This is the bank's standard checking account for everyday banking. The $15 monthly maintenance fee is waived if you keep a minimum daily balance of $100. There's also no monthly maintenance fee for students aged 17 to 23. The Toronto-Dominion Bank operates as a bank in North America.

The Company's segments include Canadian Retail, U.S. Retail, Wholesale Banking and corporate. Canadian Retail segment serves customers in the Canadian personal and commercial banking, wealth, and insurance businesses. Personal Banking provides financial products and advice through its network of automated teller machines , telephone, digital and mobile banking. Retail comprises the Bank's personal and business banking operations under the brand TD Bank and wealth management in the United States. TD Online Accounting helps businesses increase and accelerate their cash flow by providing a self-service, digital onboarding experience to help business owners get paid electronically. As a payment facilitator, Autobooks enables a business to begin invoicing within moments of enrollment and to start processing payments shortly after.

For ease of use, TD Online Accounting is available to current TD business customers with a business checking account who are enrolled in online banking. If you want a basic checking account and are willing to pay a monthly fee of $5.99, this account offers a debit card, online banking and other everyday checking account features with no minimum balance requirement. TD Online Accounting provides a self-service, digital onboarding experience to help business owners get paid electronically. As a payment facilitator, Autobooks enables a business to begin invoicing within moments of enrolment and to start processing payments shortly after. The feature is available to current TD business customers with a business checking account who are enrolled in online banking.

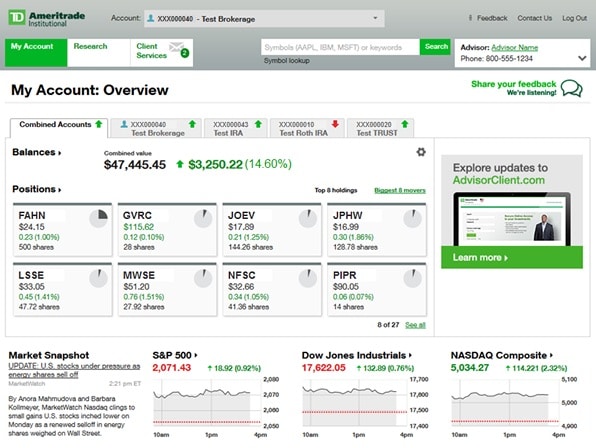

TD Bank Online banking services have made it easy for customers to bank any time provided they have enrolled for free services. Customers can also access their bank accounts online on their mobile web browsers or by downloading the mobile app of playstore and itunes. This guide will direct you on how to access your online account, how to reset the password in case you want to and enrolling for the internet banking services. Download our mobile app to get on-the-go access to your accounts and bank securely 24/7. Anywhere you are, view your balance, deposit checks, send money, transfer funds, pay bills and more.

TD Bank is a full-service bank that offers loans, credit cards and other financial products. If you have a checking account with them, it may provide you with a better deal on a personal loan, a mortgage or other financial accounts. It places a strong emphasis on customer service and makes it easy to contact customer service via in-app communication, social media channels, as well as email or phone.

This is a checking account with more perks and features than Convenience Checking, but you need to have a more significant banking relationship with TD Bank to make it worthwhile. Still, the fee can be waived if you make monthly direct deposits of $5,000 or more, keep a minimum daily balance of $2,500 in the account or have a combined balance of $25,000 across multiple TD Bank accounts. Qualifying customers with the TD Beyond Checking account also get free ATM transactions at non-TD Bank ATMs, two free overdraft fees per year and other perks like free standard checks. The Beyond Checking account also pays interest, but the APY is currently 0.01%. In addition, TD Bank and its subsidiaries offer customized private banking and wealth management services through TD Wealth®, and vehicle financing and dealer commercial services through TD Auto Finance. TD Bank is headquartered in Cherry Hill, N.J. To learn more, visit Find TD Bank on Facebook at /TDBank and on Twitter at /TDBank_US.

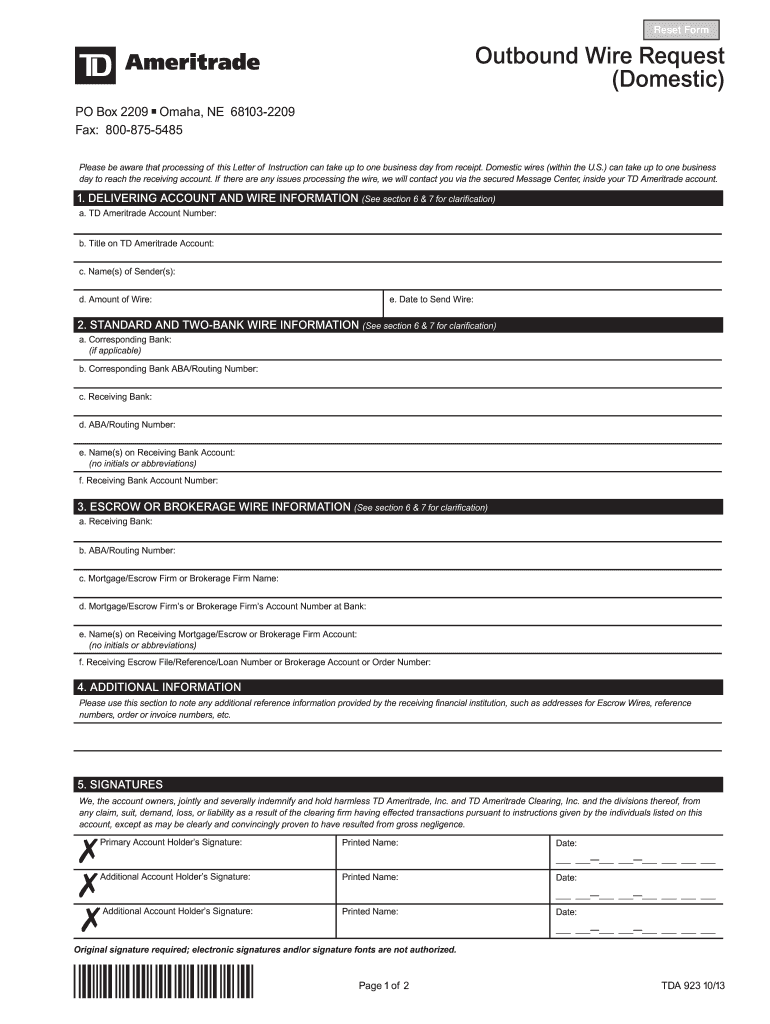

Popmoney enables customers to send money to almost anyone they know or owe using the recipient's name and email address or mobile phone number, eliminating the hassles of cash or checks. Customers can also request and receive money directly into their TD Bank accounts. TransferNow offers customers a way to transfer funds to or from their own non-TD Bank accounts, making overall funds management easier by eliminating extra steps involved in withdrawing and depositing money at different banks.

Some banks offer checking accounts without monthly fees, overdraft fees or non-sufficient funds fees, including Discover Bank's checking accountand online bank Simple's checking account. Wells Fargo plans to roll out two types of checking accounts without overdraft fees early next year. TD Bank is headquartered in Cherry Hill, N.J. To learn more, visit Find TD Bank on Facebook at /TDBank and on Twitter at /TDBank_US . The tablet enables users to manage their personal bank accounts and check their balances and transactions for checking, saving and money market accounts. TD Bank has found that consumers prefer online banking on tablets due to the wider screen and easier ability to see figures and details. With over 1,250 locations throughout the Northeast and Southeast regions of the U.S., TD Bank offers a robust brick-and-mortar presence and an array of checking and savings account options.

For consumers who value banking with a big brand that has a large physical footprint, as well as those who prioritize checking and savings accounts that offer competitive sign-up bonuses, TD Bank could be a good choice. However, compared with other banks — particularly online banks — TD Bank falls short in terms of offering competitive rates and minimizing fees. TD Online Accounting uses the technology of Autobooks, an integrated accounting and receivables platform that allows business owners to get paid faster by settling credit card and electronic payments directly in their TD Bank business checking account. Accelerating transaction settlement times is especially important for businesses as they seek to maintain a healthy cash flow as a result of COVID-19.

External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address and a social security number. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. 1Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number and an active unique e-mail address.

Message and data rates may apply, check with your wireless carrier. However, if you want the convenience and accessibility of banking at a larger regional bank with a footprint throughout the East Coast, TD Bank offers some valuable features and benefits. The mobile app is highly rated and well designed for everyday banking. It offers convenient features like compatibility with digital wallets, mobile check deposit and the ability to send money with Zelle.

The bank, along with its subsidiaries offer customized private banking and wealth management services through TD Wealth and vehicle financing and commercial dealer services through TD Auto Finance. TD Online Accounting uses the technology of Autobooks, an integrated accounting and receivables platform that allows business owners to get paid by settling credit card and electronic payments directly in their TD Bank business checking account. US-based TD Bank has enhanced its online banking business by launching person-to-person payment and external transfer services, allowing customers to securely transfer money to accounts at any US bank or to other people.

TD Bank is the U.S. commercial banking arm of Canada's TD Bank Group. The bank offers a full suite of products, including checking accounts, savings accounts and mortgages, as well as small business and commercial products. The bank has more than 1,200 branches stretching along the East Coast from Maine to Florida. Those looking for a bank to handle their everyday financial needs should certainly find themselves satisfied with TD Bank.

The bank's account fees that are a top-ranked pet peeve of many people are a commonplace in the whole banking industry and are also the price that is paid for financial stability and security of the top Canadian financial institutions. The bank uses the money they get from fees to improve customer support and have acted to the requests of their clients for more convenient hours and improved online options. Like many other major banks, TD Bank is currently operating in a near-zero interest rate environment that makes it hard to offer very compelling APYs on savings accounts, money market accounts and CDs. If you want higher APYs on your savings, you may want to consider an online bank or credit union. There is a $5 monthly maintenance fee for this account, which the bank will waive if you maintain a $300 minimum daily balance or link your savings account to a qualifying TD Bank checking account. Banks typically charge overdraft fees when you overdraw your checking account.

Instead of having your debit card declined or the purchase canceled, your bank will cover the difference and charge you an overdraft fee. TD Bank, for example, charges $35 when you overdraft your account by more than $5 and levies up to five of these charges per day. Using the services, customers can select one-time or recurring transfers to or from their non-TD Bank accounts, send money to other person's TD Bank or non-TD Bank account, or request money from another person.

The P2P payments and transfers are currently available to and from US-based bank accounts only. You'll have a safety net in that you can connect with a live customer service representative by phone 24 hours a day, seven days a week. TD Bank also offers VoicePrint technology to its customers. With your permission, you can enroll in VoicePrint, which uses more than 100 different characteristics that represent your voice, when you call the bank's customer service. The bank offers a wide range of financial services to small business and personal clients.

It is pretty easy to open a savings or checking account at TD Bank once you have decided on the type of account that you think will be suitable for you. One thing to note about PNC is that its monthly fees are significantly lower than TD Bank's, but PNC Bank requires a higher minimum balance of $500 to keep its standard checking account free from month to month. If you're just looking for a standard checking account, TD Bank may be an easier option for affordable checking. However, PNC's Virtual Wallet program offers features that TD Bank's services don't cover, such as savings goals and budget tracking, making PNC a better choice for those who want more tools for managing their funds more actively.

TD Bank checking accounts give customers access to a large East Coast-based network of branches and ATMs. But you won't find free checking with TD Bank's three general options. There's either a minimum daily balance requirement or monthly fee. Accounts are available in Connecticut, Delaware, Florida, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia and Washington, D.C.

Once you're unenrolled, your debit card purchase will be declined if there's not enough money in your account. Some consumers may not be able to avoid late fees or overdrafts, especially during the pandemic when millions are unemployed. In fact, many times they occur because people simply forget, says Jim Kreyenhagen, VP of marketing and consumer services at doxo. "We get busy, we don't think about moving money from our savings account to our checking account, we haven't set up an automatic transfer, so we overdraft." TD Bank offers a money market account with tiered interest rates.

There's no deposit required to open the account though and online bill pay and mobile deposit are available. There are higher rates available elsewhere, especially from online banks. The bank's internet banking portal is called EasyWeb and makes it easy for clients to manage their bank accounts around the clock from anywhere in the world as long as they are connected to the internet. For those who want to bank even when they are on the go, there is a free app that they can download to their mobile devices. The EasyWeb portal and mobile apps offer online security guarantee and any unauthorized transactions are usually reimbursed by the bank.

If you can maintain a daily balance of at least $2,500, TD Bank will reimburse you for all ATM fees incurred. Another standout checking account is TD Bank's Convenience Checking account, as it requires a low minimum balance of $100 to waive its $15 monthly maintenance fee. Person-to-person payments and transfers are available to and from U.S.-based bank accounts.

Both services are part of the Fiserv suite of digital money movement solutions, which also includes the CheckFree® RXP® bill payment service utilized by the bank. The Company offers online banking, mortgages, loans, insurance, and investment management services. TD Bank uses Popmoney, developed by Fiserv, to provide customers with P2P payment options. Popmoney allows customers to send money to or request money from other people using their email address or mobile phone number. TD Bank offers a number of options for checking customers.

It's popular TD Convenience Checking account comes with just a $100 minimum daily balance requirement to dodge the $15 monthly fee. A bank spokesman said Tuesday that while the company is making progress on fixing the glitch, he acknowledged that a number of its customers are still unable to use mobile or online platforms to check their accounts, transfer funds or pay bills. TD Bank offers higher APYs to encourage customers to open multiple accounts and do more banking business with them. However, even with its relationship bump, the TD Bank savings account rates are quite low—significantly lower than the best online savings accounts.

Areas in which TD Bank falls short are its fees and interest offered. While many checking and savings accounts have no monthly maintenance fees without needing to meet any qualifications, many of TD Bank's products require customers to jump through hoops to get their fees waived. Additionally, the interest offered on TD Bank's deposit products is minimal when compared with the bank's online-only peers. This review covers everything you need to know about TD Bank so you can determine whether it's a good option for you.

While TD Bank offers a variety of financial services, this review focuses on its checking and savings account products. Large institutions like TD Bank generally have a wide network of branches and ATMs. However, their checking accounts tend to have lower interest rates and higher monthly fees compared with online banks. The top online banks can't match big banks in the number of branches, but they do usually offer access to large independent ATM networks. With Online Banking, you'll be able to view and manage all of your TD Bank business accounts in one place ?

Pay bills, transfer money, schedule ACH transfers, and deposit checks. As the business owner, you can also set up designated users who can complete these tasks on your behalf with the permissions you set. Our Mobile Banking App offers convenience on the go while you are out and about. You can check your account balances, view and perform transactions, and view your check images. Our funds transfer feature allows you to move funds immediately between your accounts or schedule future transfers.

Our bill pay feature is easy to use and you can pay almost any company or person. TD Bank offers customers a few different options for savings. With its Simple Savings account, you can earn interest, but it comes with a $5 monthly fee. Luckily there are a few easy options available for getting the fee waived, such as keeping at least $300 in the account.

The convenience that the internet has brought has made gone are the days of needing all your financial services under one roof. You can bank from anywhere in the world provided you have internet connection. And smartphones have made this a lot easy since you can now bank even when you are on the go. TD Bank has embraced technology in its endeavors to provide customers with reliable and convenient banking services. Customers only need to register on the bank's website to get started with internet banking. When it comes to credit cards, this bank deals exclusively with Visa, and offer a wide range of reward programs from cash back rewards to travel points.

There are business and personal credit cards as well as special offers for students. The annual fees and interest rates vary between the different cards, but they all fall in marketplace averages. You get a slightly higher APY if you have a banking relationship with TD Bank and link other qualifying accounts to your savings account.

Beyond Savings requires a $20,000 minimum daily balance; to earn 0.15% APY, the minimum daily balance is $250,000. TD Bank's student checking account offers special perks for students and young adults ages 17 to 23, such as no monthly fee and no minimum deposit. TD Bank has partnered with Fiserv to offer Popmoney to provide customers P2P payment options, complementing the bank's convenient online banking tools. TD Bank has recently launched person-to-person payment and external transfer services, providing customers with an option to transfer money to accounts at any US bank or to other people.